Who Pays Owner's Title Policy In Florida

The contract should always stipulate who pays for the Florida title insurance. In Florida the buyer or seller may purchase both the lenders policy and the owners policy.

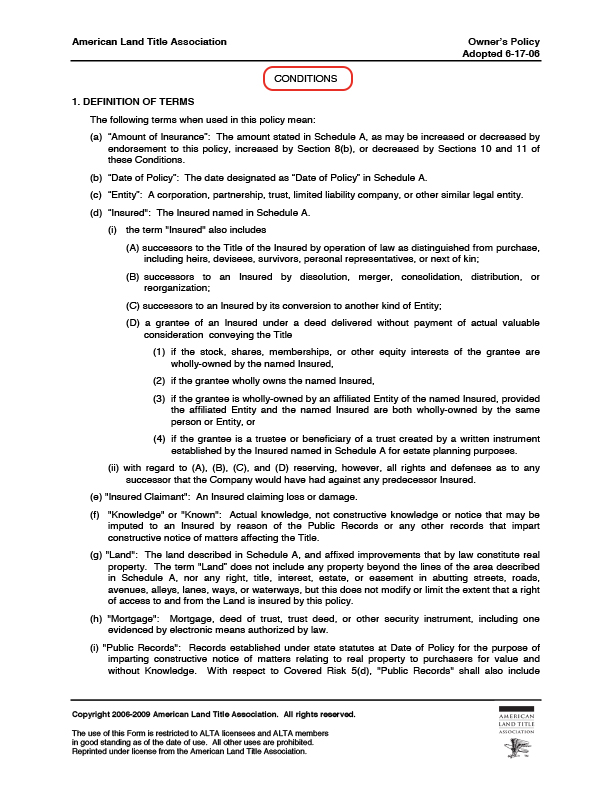

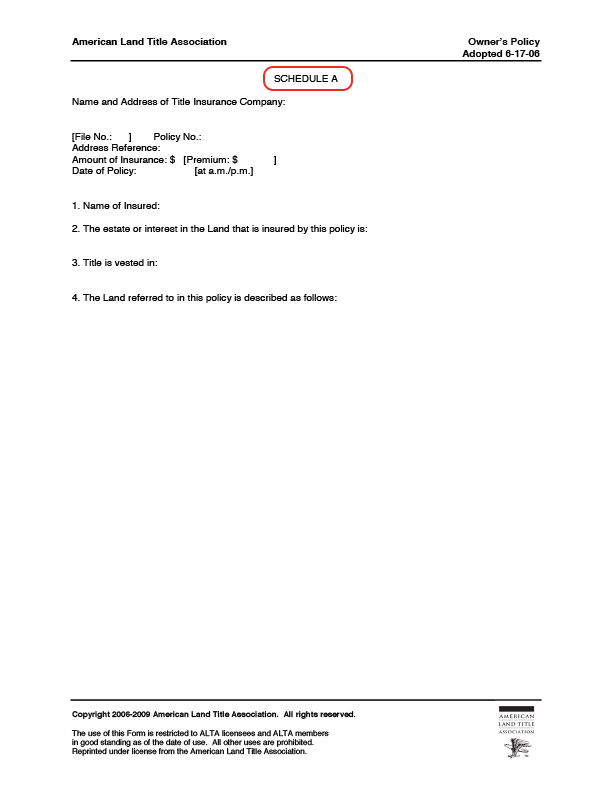

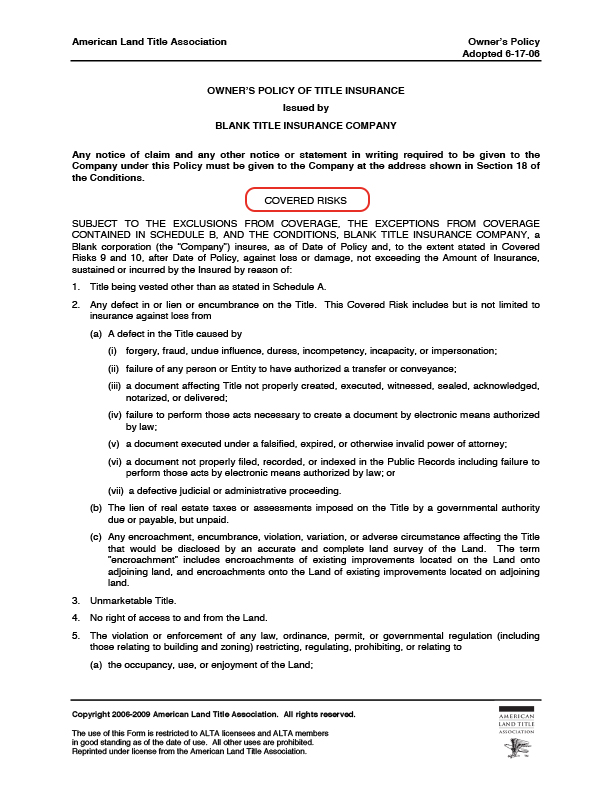

Parts Of A Title Policy Home Closing 101

A Florida title insurance owners policy and a Florida title insurance lender policy are generally issued simultaneously with the policy of lesser value having only a nominal premium rate.

Who pays owner's title policy in florida. Upon closing the cost of the home owners title insurance policy is added to the sellers settlement statement and the lenders title insurance policy is covered by the buyer before closing. Depending on what county you are located in Florida sometimes it is customary that the seller pays title insurance. Title agents and title insurance companies may.

200 per 1000 Simultaneous Policy. Who pays title insurance is usually negotiated between the buyer and seller. In the case of the home buyers title insurance policy its customary for the seller to pay the costs of the policy issued to the new homeownermortgage lenders also require a title.

Who pays for title insurance in florida. In at least one county who pays the premium depends on where the property is located within the county. If the seller pays for the owners title policy it is also typical for the seller to select the title agency.

This is due to conflicting local customs. The title is the buyers legal right to possess the property and use it within the restrictions imposed by zoning codes or other established limitations. Anyone who purchases real property also obtains a title to the land.

To be prepared it is best to check with your local laws before volunteering to cover those costs. Owners Title Policy if BUYERS Box is Checked or if the Miami-DadeBroward Regional Provision is Checked per Article 9 Sellers Settlement Fee. There are many areas of Florida where it is customary for the Seller to pay for the title insurance policy.

In Florida the person who pays for the title insurance varies per county. Title insurance in Florida is required by the lender and should be purchased to protect the Buyer under all circumstances but can be paid by either party in the real estate transaction. 575 per 1000 min 100 100000 to 1 million.

The only exceptions to this are Broward Miami-Dade Collier and Sarasota counties. In some instances the seller could pay for this policy as a means to sweeten the deal on their home and ensure clear title. Paying for all or a portion of the title insurance costs of appraisal property repairs home warranty decorating allowance moving allowance.

Most counties like Dade Broward Manatee and Sarasota the buyer pays title. The common standard in our region is for the buyer to pick and pay of the owner title policy and lender policy if. While most lenders require buyers to purchase a lenders title insurance policy to protect the amount lent to you an owners title insurance policy is usually.

The home buyers escrow funds end up paying for both the home owners and lenders policies. Florida Title Insurance Rates 0 to 100000. 250 per 1000 5 million to 10 million.

225 per 1000 10 million. In Florida it is more important then anywhere else for the contract to mention such. The common standard in our region is for the buyer to pick and pay of the owner title policy and lender policy if applicable.

In Florida the choice of whether the buyer or seller should designate the closing agent and pay for the owner policy is a completely negotiable item. The seller pays for the title insurance and picks the title company in most counties in the state. The party who customarily pays the owners title insurance policy premium in a residential transaction in Florida varies by county.

500 per 1000 1 million to 5 million. Owners policy helps protect the new property owner from a previous owners debts such as being required to pay a lien placed against the property due to the actions or inactions of a prior owner. An owners title insurance policy is a buyers best protection against possible defects in property ownership that could remain hidden even after a thorough public record search.

In some cases negotiations can be with respect to costs in the contract. As for owners title insurance this cost is optional and up for negotiation in regards to who pays. The person paying the title insurance premium gets the first choice of closingtitle agent.

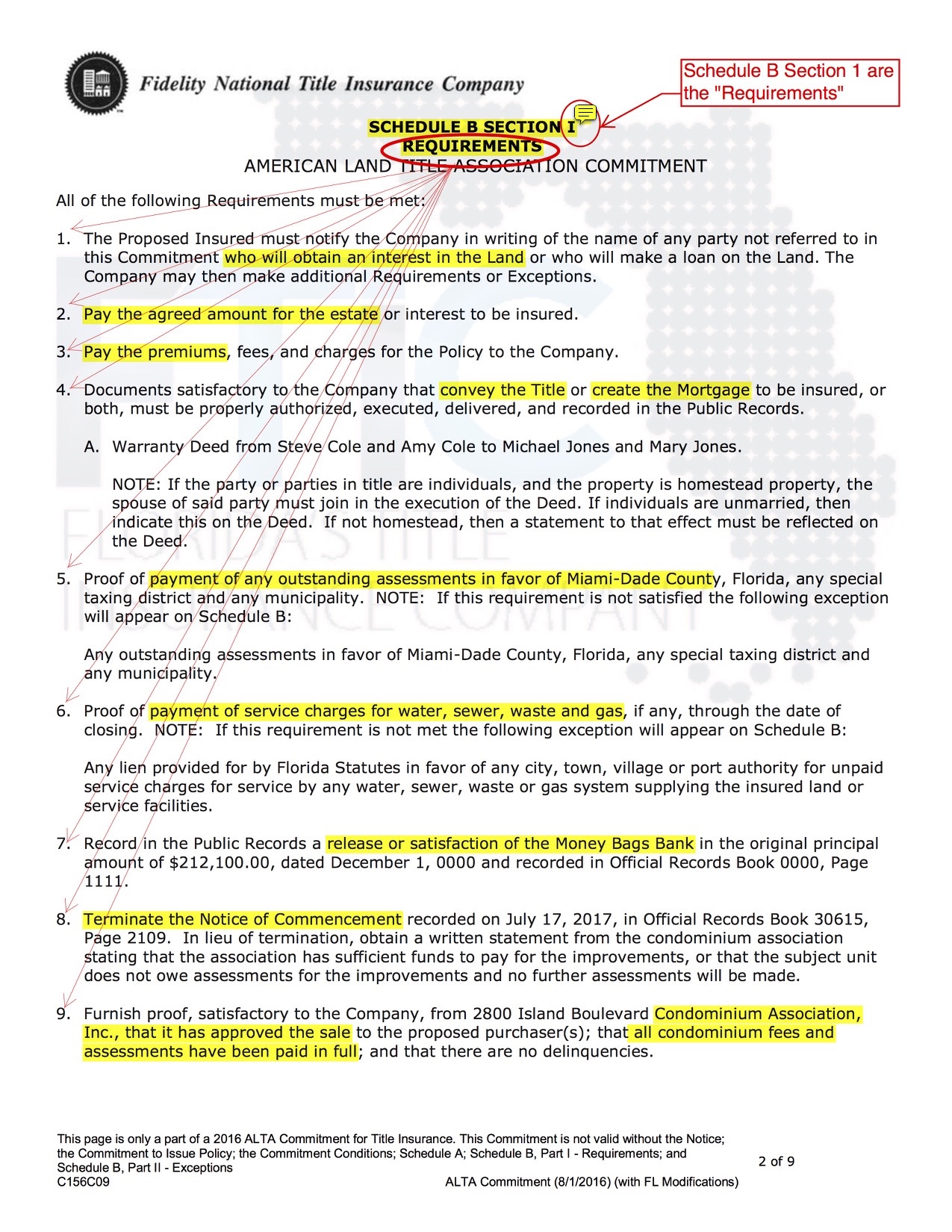

How To Read A Title Commitment Florida S Title Insurance Company

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

Do I Need Title Insurance In Florida

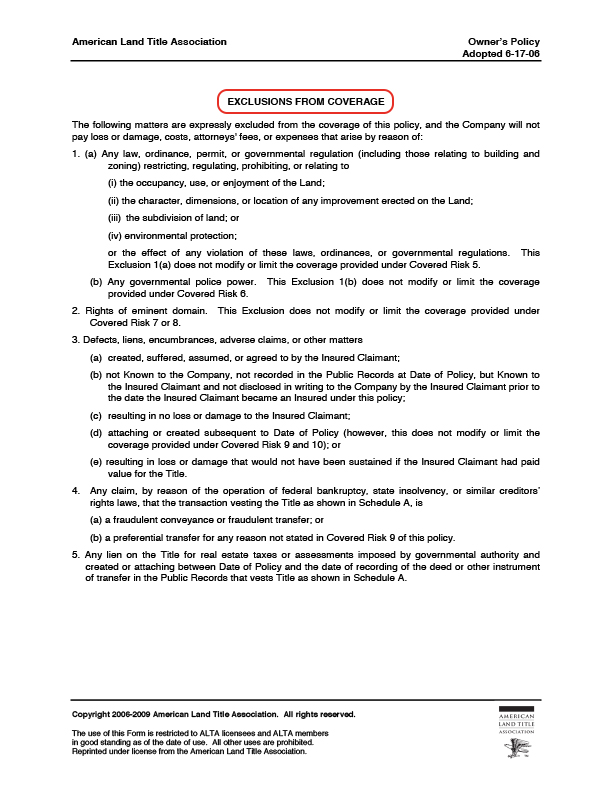

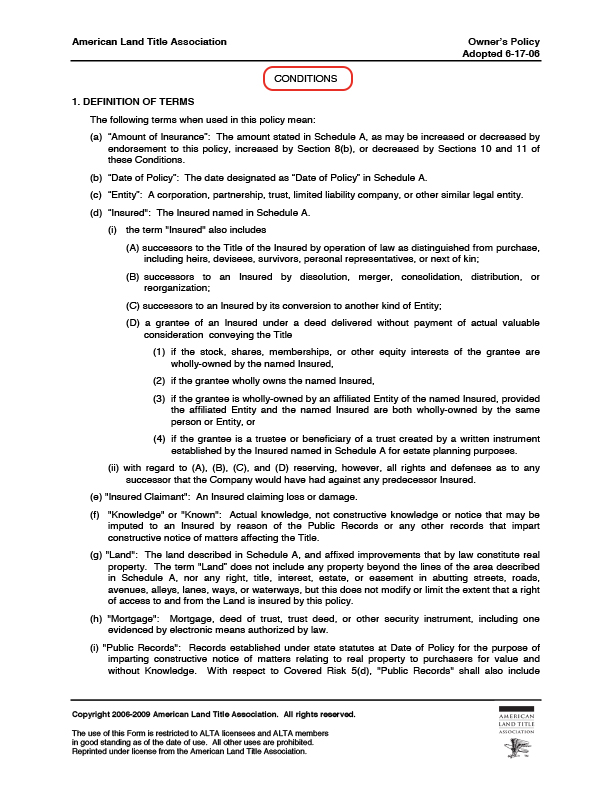

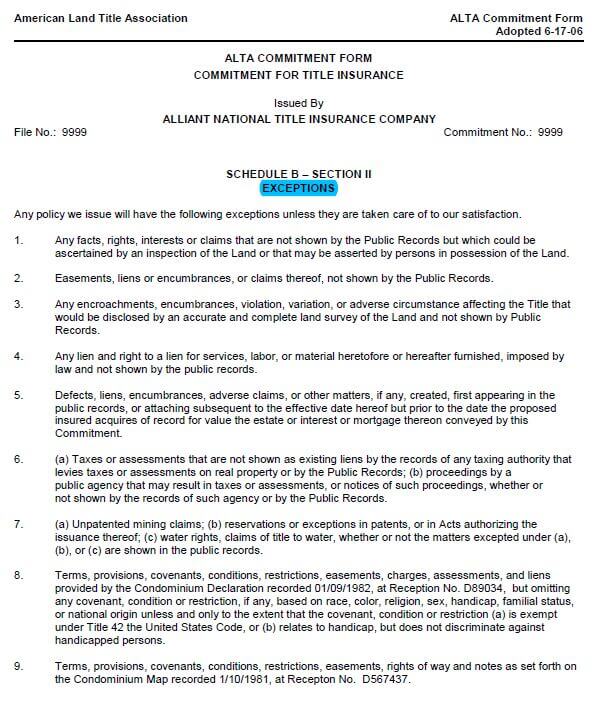

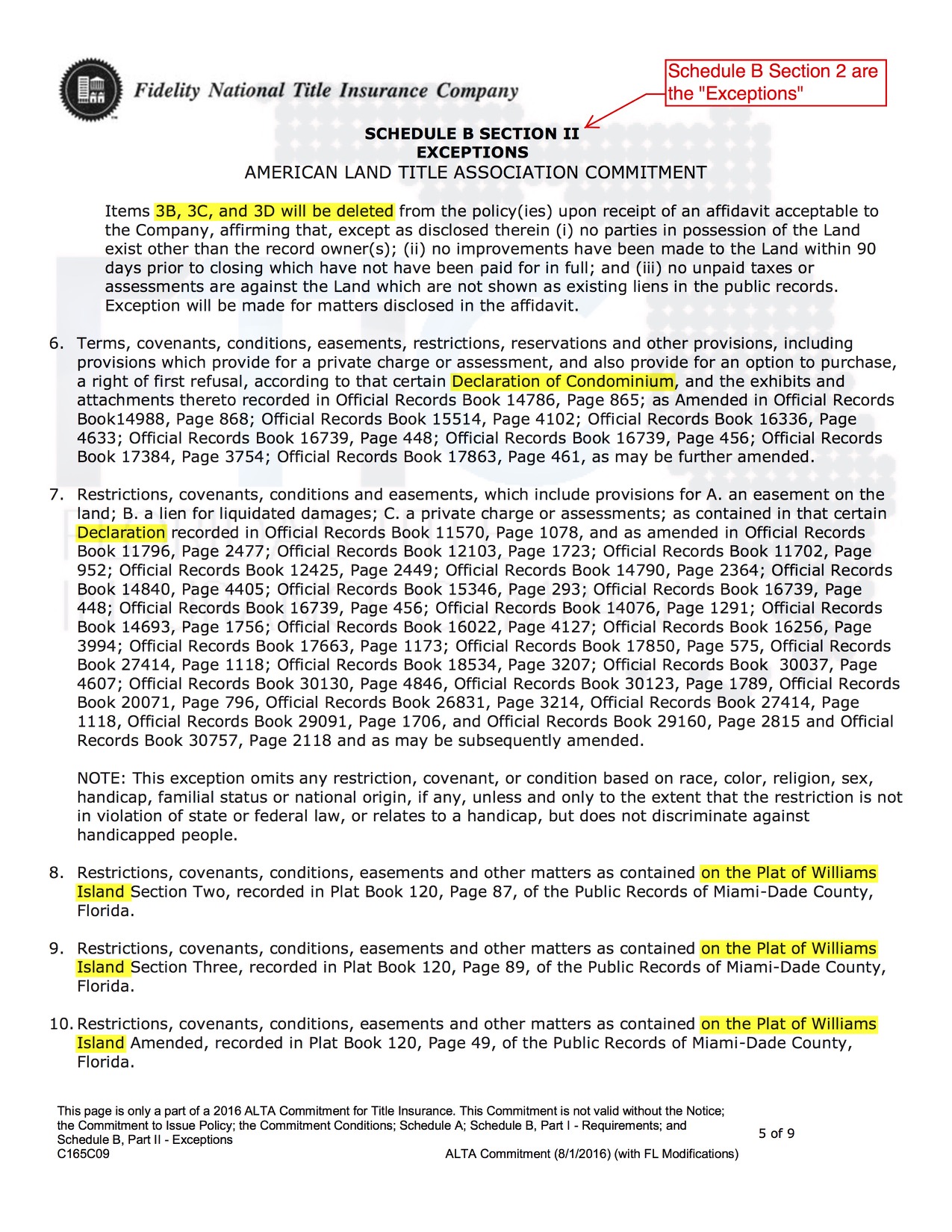

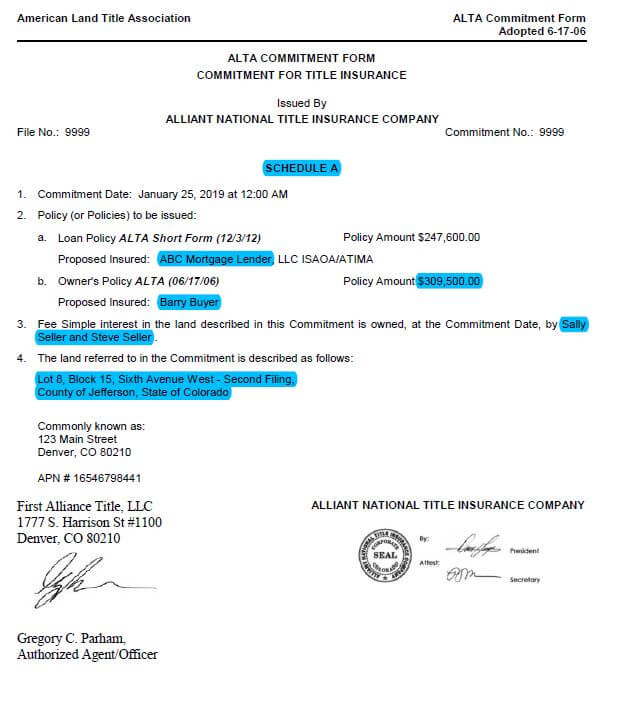

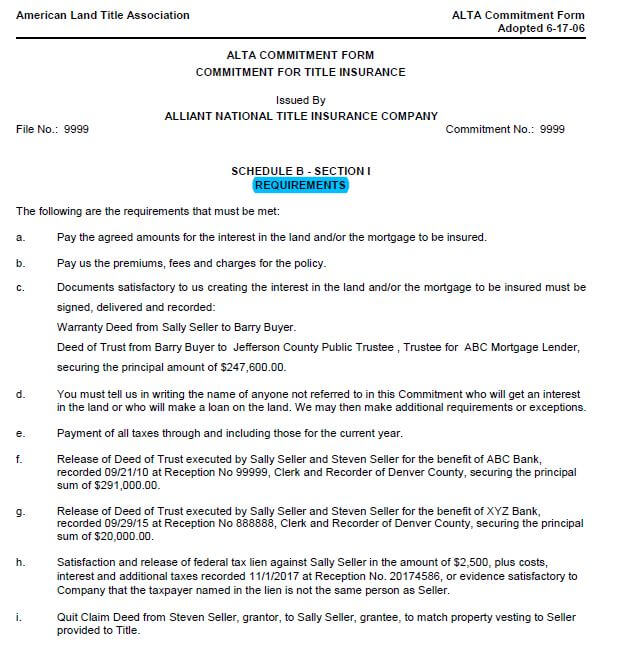

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

How To Read A Title Commitment Florida S Title Insurance Company

Parts Of A Title Policy Home Closing 101

How To Read A Title Commitment Florida S Title Insurance Company

Parts Of A Title Policy Home Closing 101

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

Who Pays For What Florida S Title Insurance Company

Https Barneswalker Com Wp Content Uploads 2014 01 Potential Dangers To Realtors In A Title Commitment Pdf

Pin By Artesian Title On Florida Title Insurance Company For Home Buyers Title Insurance Title Insurance

How To Read A Title Commitment Florida S Title Insurance Company

Https Www Alta Org File Cfm Name Common Commercial Endorsements

How To Read A Title Commitment Florida S Title Insurance Company

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

Parts Of A Title Policy Home Closing 101

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

Posting Komentar untuk "Who Pays Owner's Title Policy In Florida"